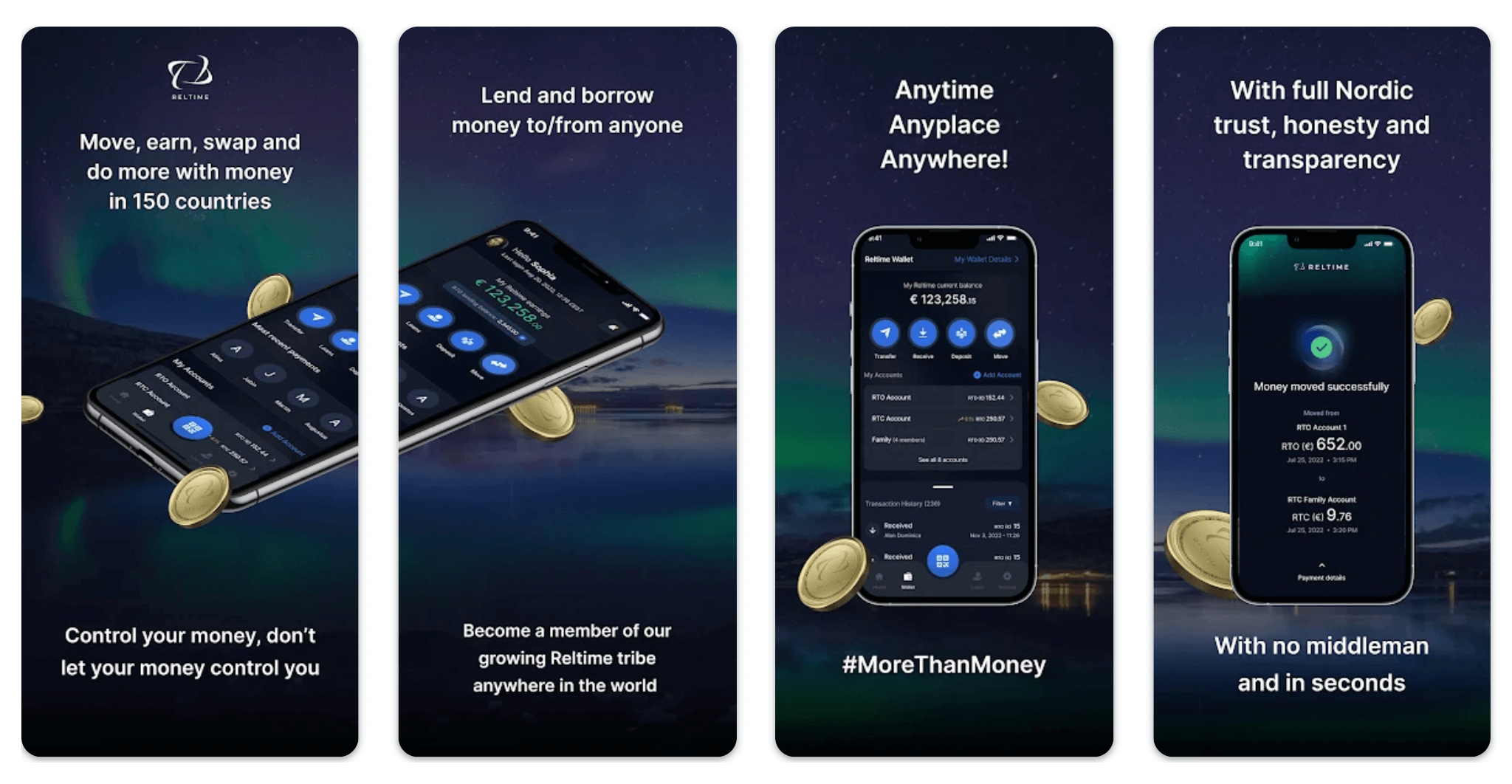

- Liquidity Provision: A Defi flash loan app allows users to access immediate liquidity without requiring collateral, enabling them to leverage their existing assets effectively.

- Efficiency and Speed: Flash loans eliminate the need for traditional loan approval processes, allowing users to execute loan transactions quickly and efficiently, often within a single Ethereum block.

- Cost-Effectiveness: With flash loans, users can avoid traditional intermediary borrowing costs, reducing fees and interest expenses.

- Accessibility: Flash loans offer financial services to a broader range of users who may not have access to traditional banking systems. It promotes financial inclusion and empowers individuals worldwide.

- Arbitrage Opportunities: Traders can leverage flash loans to exploit price discrepancies across different decentralized exchanges, maximizing profit potentials in the Defi market.

- Risk Management: Flash loans can mitigate risks by leveraging instant liquidity to address potential liquidation events, repay outstanding debts, or arbitrage opportunities in real time.

- Innovation and Experimentation: The availability of flash loans encourages developers and entrepreneurs to explore new Defi use cases, experiment with novel financial products, and drive innovation in the decentralized finance space.

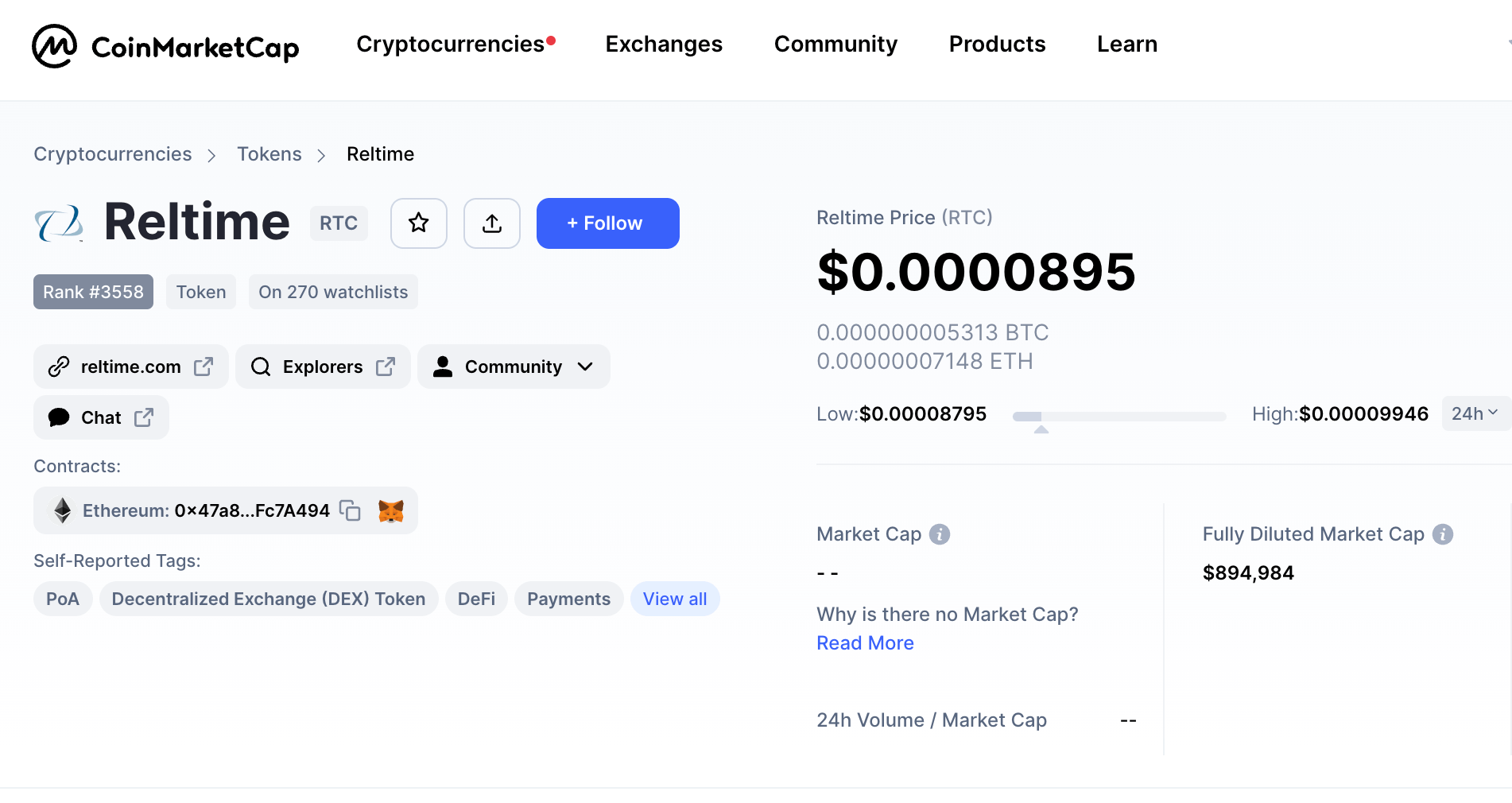

- Transparency and Security: Defi-based flash loan apps leverage the security and transparency benefits of blockchain technology, ensuring that transactions are immutable, auditable, and resistant to tampering.

- Peer-to-Peer Lending: Flash loans facilitate direct lending and borrowing between individuals, eliminating the need for intermediaries and enabling peer-to-peer interactions.

- Customizability: Defi-based flash loan apps can be tailored to suit specific business requirements and integrated with other Defi protocols, allowing for seamless interoperability within the decentralized finance ecosystem.

As a leading blockchain development company, we offer a range of customization options for a DeFi flash loan app to meet specific business requirements. Here are some key customization options available:

- User Interface (UI) Design: We can tailor the app's UI to align with your brand identity, incorporating your preferred color schemes, logos, and visual elements to create a seamless user experience.

- Features and Functionality: Our team can customize the features and functionalities of the app based on your specific requirements. This includes customizing the loan parameters, interest rates, loan duration, collateral requirements, and repayment options.

- Integration with External Services: We can integrate the Flash loan app with external services such as popular wallet providers, payment gateways, oracles, and blockchain explorers to enhance user convenience and accessibility.

- Token Support: Our team can customize the app to support specific tokens or cryptocurrencies based on your preferences and the desired blockchain network, ensuring compatibility with your existing token ecosystem.

- Smart Contract Development: We can develop smart contracts that govern flash loan operations and implement custom business logic to address your unique needs, such as specific loan terms or security measures.

- Security Enhancements: We can implement additional security measures to meet your specific requirements, including multi-factor authentication, hardware wallet integration, auditing, and encryption protocols.

- Regulatory Compliance: We can customize the app to adhere to specific regulatory requirements and compliance standards, ensuring that your flash loan operations align with applicable laws and regulations.

- Reporting and Analytics: We can incorporate customized reporting and analytics features to provide you with comprehensive insights into loan transactions, user behavior, liquidity utilization, and other relevant metrics.

- Scalability and Performance: Our development team can optimize the app's architecture and infrastructure to handle increased user traffic, ensuring scalability and high performance even during peak demand.

- Ongoing Support and Maintenance: We provide continuous support and maintenance services to address any future customization needs, bug fixes, security updates, and feature enhancements as your business evolves.

- Requirement Gathering: We start by thoroughly understanding your business requirements, goals, and target audience. We collaborate closely with you to gather all the necessary information and clarify any uncertainties.

- Architecture Design: Our experienced team of architects and developers design the overall architecture of the defi flash loan app. We consider scalability, security, and interoperability with other blockchain protocols and services.

- Smart Contract Development: We create smart contracts that govern flash loan operations, including loan issuance, collateral management, interest calculations, and repayment mechanisms. Our team ensures the solidity code adheres to industry best practices and security standards.

- User Interface (UI) and User Experience (UX) Design: Our talented designers create an intuitive and visually appealing UI/UX for the app. We focus on providing a seamless user experience, making it easy for users to interact with the flash loan app.

- Front-end and Back-end Development: Our development team implements the UI/UX designs and builds the front-end and back-end components of the app. We leverage cutting-edge technologies and frameworks to ensure the app's performance, security, and scalability.

- Integration with Blockchain and Third-party Services: We integrate the app with the desired blockchain network, ensuring seamless connectivity and data synchronization. We also integrate external services such as wallet providers, oracles, and other relevant APIs for enhanced functionality.

- Testing and Quality Assurance: We conduct rigorous testing to identify and fix any bugs, vulnerabilities, or performance issues. Our quality assurance team ensures the app functions flawlessly and meets the highest quality standards.

- Deployment and Launch: Once the app is thoroughly tested and approved, we deploy it on the desired blockchain network or infrastructure. We assist with the launch and provide the necessary support to ensure a smooth rollout.

- Ongoing Support and Maintenance: We offer ongoing support and maintenance services to address post-launch issues, implement updates, and incorporate new features or enhancements as your business needs evolve.

The cost of building a defi flash loan app can vary depending on various factors. These factors include the complexity of the desired features, the extent of customization required, the technology stack chosen, the development team's size and expertise, and the overall project requirements. Integrating third-party services, security considerations, and ongoing maintenance and support can also influence the cost. Our team will work closely with you to assess your requirements and provide a transparent and tailored pricing structure to ensure the application's successful development and deployment.

The development timeline for a defi flash loan app can vary based on several factors specific to your project. Factors such as the complexity of the desired features, customization requirements, regulatory compliance considerations, integration with third-party services, and the availability of development resources all play a role in determining the project's duration. Analyzing the project scope and requirements is essential for providing an accurate estimate.

Projects with higher complexity, extensive features, and a larger user base typically require a longer development timeline. Depending on the scope and scale, these projects may span several months or even years. The experience and expertise of the development team also contribute to the overall timeline, as their proficiency in blockchain technologies and defi protocols can streamline the development process.