In this article, we elaborate on the process of blockchain peer-to-peer lending, explaining its definition, benefits, processes, and potential. The discussion also goes on to describe its key features that encompass its present form.

Blockchain technology has made its mark in a spate of industries and is set to make waves in the area of finances as well. When it comes to loans and lending, before banks came into the scene, people used to rely on each other, i.e. peer-to-peer, without intermediaries. After a while, the issue of security led to the idea of collateral to protect lenders from fraud and deceit. Over time, the lending industry has developed and globalization has played a significant role to bring it to its current form.

Now, person-to-person lending also takes place through online platforms which are usually free of financial institutions’ interference. The online medium charges a particular fee to both borrowers and lenders and then designs documents, calculates interest rates, forms repayment terms, and distributes finances. In the case of the loan not being paid, the online platform sells it to a debt collection agency.

P2P lending gives different kinds of borrowers an option that doesn’t charge an exorbitant amount of interest rates. Especially after the financial crisis of 2008, P2P lending turned mainstream after being an alternative for a long time. P2P structure also offers many advantages over traditional institutions like transparency, low-interest rates, the malleability of the participants, etc.

With the entry of blockchain technology in the financial industry, more specifically blockchain peer-to-peer lending, we can see its potential to make the lending process more flexible, safer, and efficient.

Let’s have a look at the below facts.

Here, we will discuss in detail how does blockchain-based P2P lending work and what are the major benefits this form of lending has to offer –

What is blockchain-based P2P lending?

Occurring on the blockchain network, borrowers and lenders enter into a loan contract without the presence of an intermediary. The lenders lend money through cryptocurrencies and get interest rates on their investment. The borrowers need to submit collateral in the form of crypto assets to secure the money the investor has lent. Just like a normal bank loan, collateral is used to reimburse the lender if the loan isn’t repaid correctly.

How does it work?

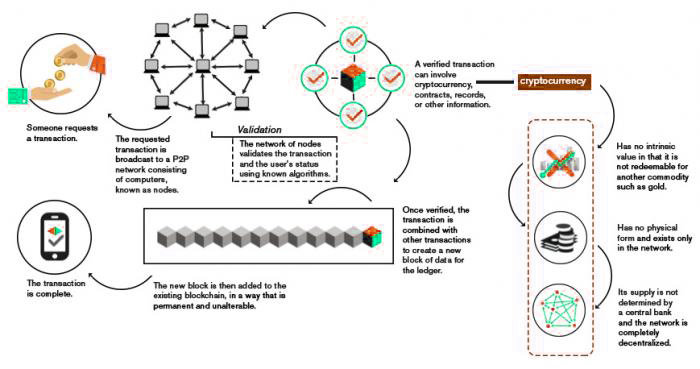

Blockchain peer-to-peer lending involves an online marketplace that doesn’t hold funds but serves as a platform to bring together borrowers and lenders. It ensures that the loan process works swiftly. The security of a loan on a blockchain network includes “smart contracts” which are pertinent in ensuring the sanctity of the loan. It is a self-executing entity that automatically programs the terms and conditions in the loan contract. Its job is to track and enforce the contract by monitoring it through an algorithm. It returns or takes the collateral depending on the execution of the loan. The automation of the contract eliminates the need for a trustworthy intermediary. Other than smart contracts, here are the steps involved in performing a lending/borrowing transaction through the blockchain network.

- Lender creates a profile on the lending platform. They fill in their personal and banking details. They also need to add the kind of investment they want to make and specify criteria for the borrowers like rate of interest. After submission, the lender’s profile is added to the P2P lending marketplace.

- After the successful creation of the profile, the lender waits for a loan request. Once a request is received, they can schedule an interview for the borrower to discuss further terms.

- For the borrower, post the creation of the profile which includes their details and purpose of the loan, they are able to send requests to the investors whose lending capacity and specifics match theirs.

- When a match is created, the interview process includes a discussion where the lender and borrower talk about the reason for the loan, monthly earnings of the borrower, repayment rate, credit history, and other relevant questions. This is followed by an acceptance or rejection of the loan.

- Once the loan is approved, a smart contract fixes the rate of interest which considers different factors like the borrower’s categorization into high, low, or medium risk; the type and purpose of the loan, etc.

- Then, the payment happens through smart contracts. After the terms generated in the smart contract, a payment request is made on the decided date through which the borrower can repay the loan. It can be done through the crypto-wallet in the smart contract. If the payment is not done on time, a late fee is added and the ledger is updated by the smart contract.

Blockchain P2P lending differs widely from conventional loan models followed by banks and other mainstream financial entities. Following are the major distinctions between the budding blockchain peer-to-peer lending network and other older methods.

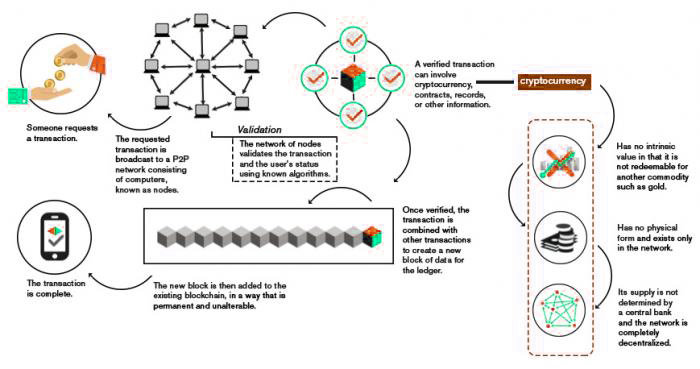

- Cryptocurrency vs fiat money: The cryptocurrencies that are used in the lending process are mediums of exchange but they do not contain any inherent value like USD, INR, or Euros. Cryptocurrencies provide a common unit of money that helps in performing smooth transactions from all over the world and doesn’t involve any fees in exchanging currencies. This provides the participants a lot of flexibility.

- Over-collateralized lending: While lending to an international borrower, the collateral performs the function of protecting the lender’s investment. On the blockchain network, the loans are over collateralized, i.e. the collateral is more than the money borrowed. For every $50 borrowed, the collateral can be $80 or $100 or more. Even though this sounds difficult, it is meant for those who have tax problems in their countries, lack of liquidity, need for fast cash, or want to store their cryptocurrencies.

- Smart contract: Financial institutions use paper contracts and execute the loan through a third party whereas the P2P blockchain uses smart contracts and one doesn’t need to rely on a person or intermediary for implementation. One doesn’t need to trust a central figure for enforcing the loan.

- Crypto lending liquidity pools: If the investor doesn’t wish to go through the process of P2P matching, interviewing, etc., they can skip the matching process and earn a fixed rate of interest. By investing in a liquidity pool, the investor can lend to anyone who provides the mentioned collateral. It is a very easy and fast way to invest your money.

Features of blockchain peer to peer lending

- Transparency of data: Cryptocurrencies are often praised for their transparency. Every transaction, every process is available at the blockchain ledger and is accessible to everyone. As a lender, you will be able to observe statistics and information that will help you make a better decision about lending. Auditing is another added advantage that is provided by plenty of blockchain networks, revealing the financial health of the platform.

- Decentralization: As mentioned above, the elimination of a middle authority makes it a decentralized entity. Blockchain peer-to-peer lending uses smart contacts instead. They make the participant an owner of the bonds which it issues through cryptocurrency.

- Search facility: One can look for lenders or borrowers that suit their criteria without the hassle of going through every borrower’s profile. It is a form of auto-investment where you can choose your investment and expand your profile.

Benefits of blockchain P2P lending

The revolution of blockchain has led to a plethora of perks that one can take advantage of. This has caused the rise of P2P lending platforms that use blockchain. Here are some of the many benefits this form of lending has to offer:

- Increased scalability: There are plenty of people in the world who do not own a bank account but can access the internet and believe more in it than financial institutions. The pool of participants is bigger on the blockchain.

- Faster and more efficient process: The automatic process of matching that takes place makes the whole task of lending very easy and fast. One doesn’t need to wait much as participants from all over the world are present on the platform, increasing the chances of investment and loan. Also, transactions done on the blockchain platform are really quick, especially when compared to traditional financial institutions.

- Reduced cost: Since the need for a middleman is eradicated, their charges also go away. Also, one doesn’t need to pay sky-rocketing interest rates as they are already fixed by the smart contracts based on the risk profile of the borrower.

- Loan tokenization: The transformation of assets into units that store value is called loan tokenization. It is a pertinent advantage offered by blockchain platforms. Participants can exchange anything, in any currency on a blockchain platform- transparently and securely.

- Identity protection: Blockchain platforms don’t require you to enter bank details or credit card numbers, protecting your fiat money. Digital money doesn’t ask for details other than the amount of transaction.

One can navigate a multitude of problems through P2P lending. It is made for those whose countries are going through global sanctions, who don’t possess the right currency in their accounts, whose countries restrict transnational transactions etc.

Thus, cryptocurrencies have turned out to be a great alternative to fiat money and blockchain networks have become the safer and transparent option than banks and other mainstream institutes. There is an understandable interest in the groundbreaking potential of blockchain which is being monetized by industries, their number increasing every day. And why not, there has been an observable positive difference in digital money. Lending is one area where blockchain’s promising prospects are visible and are being utilized. If you would like to implement blockchain-based P2P lending in your business operations, our experts can help you out. Reach out to us today.