People are constantly looking for new ways to increase their income. This hunt continued even after the fiat currency gave way to the newest kind of cryptocurrency. The ongoing quest has emerged new methods of investing and earning money. Yield farming is one such method. We may sum up it as locking up the current asset to get further incentives in the form of interest.

Have a look at the below-listed topics to know more:

Yield farming is a strategy of gaining more cryptocurrency by lending your existing ones. Let me explain this to you with an example. Let us assume that there is a complex puzzle with its own rules and regulations. The puzzle rewards the person who tries to solve it with a coin. Also, solving puzzles requires some coins. So you decided to solve that puzzle using the coins you already have.

So you put the existing coins in the complex puzzle, and then you get new coins as rewards for solving a small part of the puzzle. So you now have more coins, so you can again invest your coins in the same or different puzzle for more rewards. Moreover, this looks like a loop to make more money, right?

The puzzle here is known as liquidity pools. A liquidity pool is a smart contract that contains funds. Similar to adding more coins to solve the puzzle, you will add liquidity to the pool. The players are called liquidity providers. Liquidity providers or LPs get a reward for providing liquidity to the pool, similar to the rewards for trying to solve the puzzle. Sometimes multiple tokens would be the rewards.

So you can deposit these multiple tokens to other liquidity pools to earn more rewards there. One crucial element here is the type of puzzle you will play, i.e., the type of liquidity pool or the smart contract you want to invest in. Implementing a well-planned strategy is important because nobody wants to lose their hard-earned money in any liquidity pool.

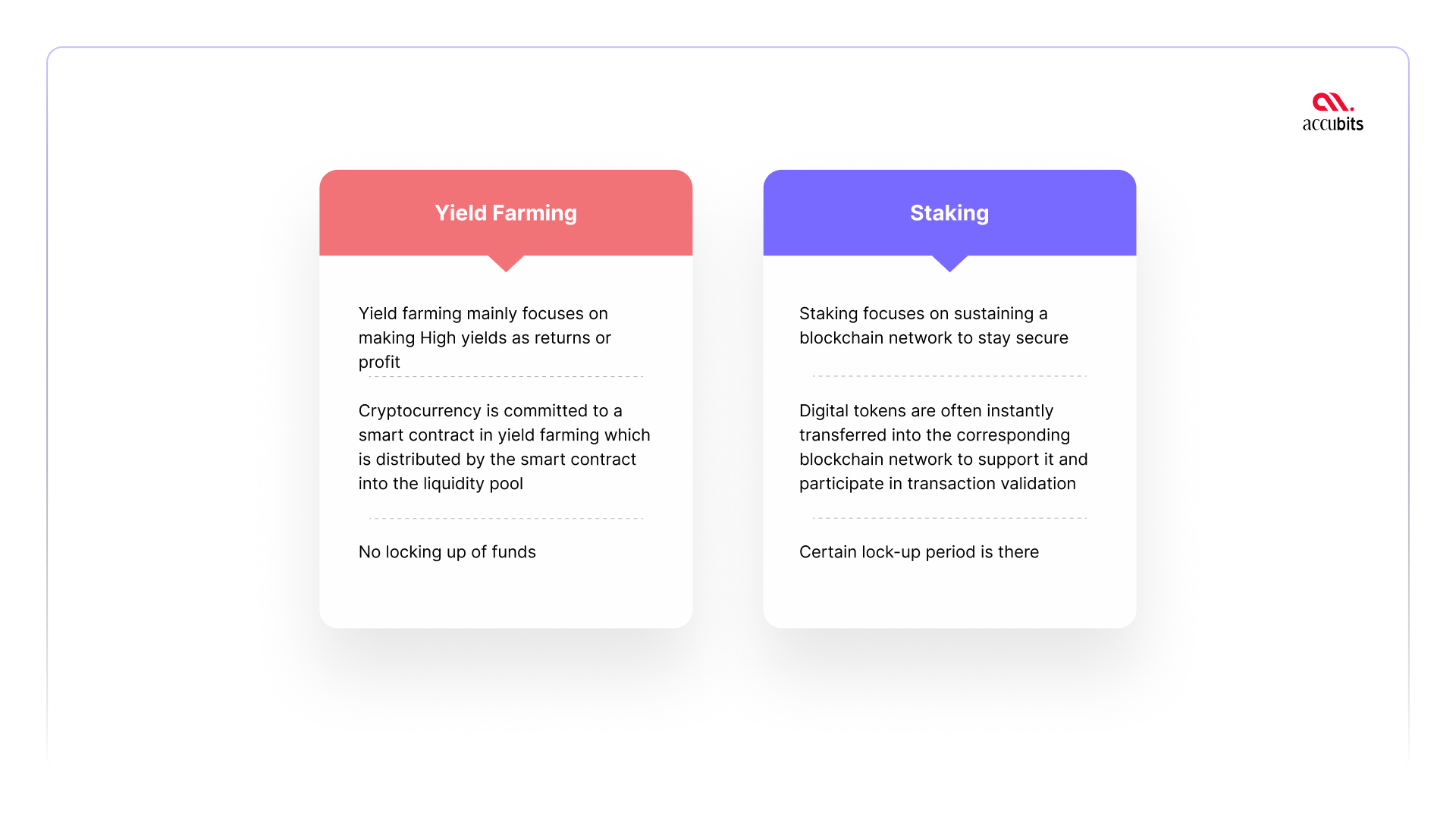

Let us try to understand the difference between these two token models, which might look the same yet different.

In yield farming, the user will lend the cryptocurrencies to a decentralized exchange, and in return, they will have a portion of platform fees paid for by the token swappers who access the liquidity. For instance, a trader must pay a fee to swap Ethereum (ETH) for Dai (DAI) using the DEX. Depending on how much liquidity they contribute to the pool, the liquidity providers or those who lent their crypto receive a portion of this charge. The benefits increase as more capital is contributed to the liquidity pool.

Blockchain networks that employ the proof of stake (PoS) consensus algorithm are used for staking. While waiting for block rewards, investors receive interest on their deposits while waiting for the distribution of block rewards. Unlike the proof-of-work (PoW) mechanism, Proof-of-stake (PoS) blockchains consume less energy since they don’t need a lot of computer power to validate new blocks. Instead, a PoS blockchain uses nodes or servers that process transactions to confirm transactions and serve as checkpoints. Users on the network, known as “validators,” set up nodes chosen randomly to sign blocks and are rewarded for doing so.

The exchange will take care of the node setup. Thus, investors don’t have to worry about it. Both models have their own unique benefits and risks. For short-term investments, staking seems a good option since it gives us immediate steady profit during the transaction validation process.

There is no locking up of funds in this model; hence there is a possibility to generate a very high amount of APY compared to staking. Considering both models’ pros and cons, it is important to remember that a proper investment strategy, better implementation, and a little luck are inevitable to reap high profits.

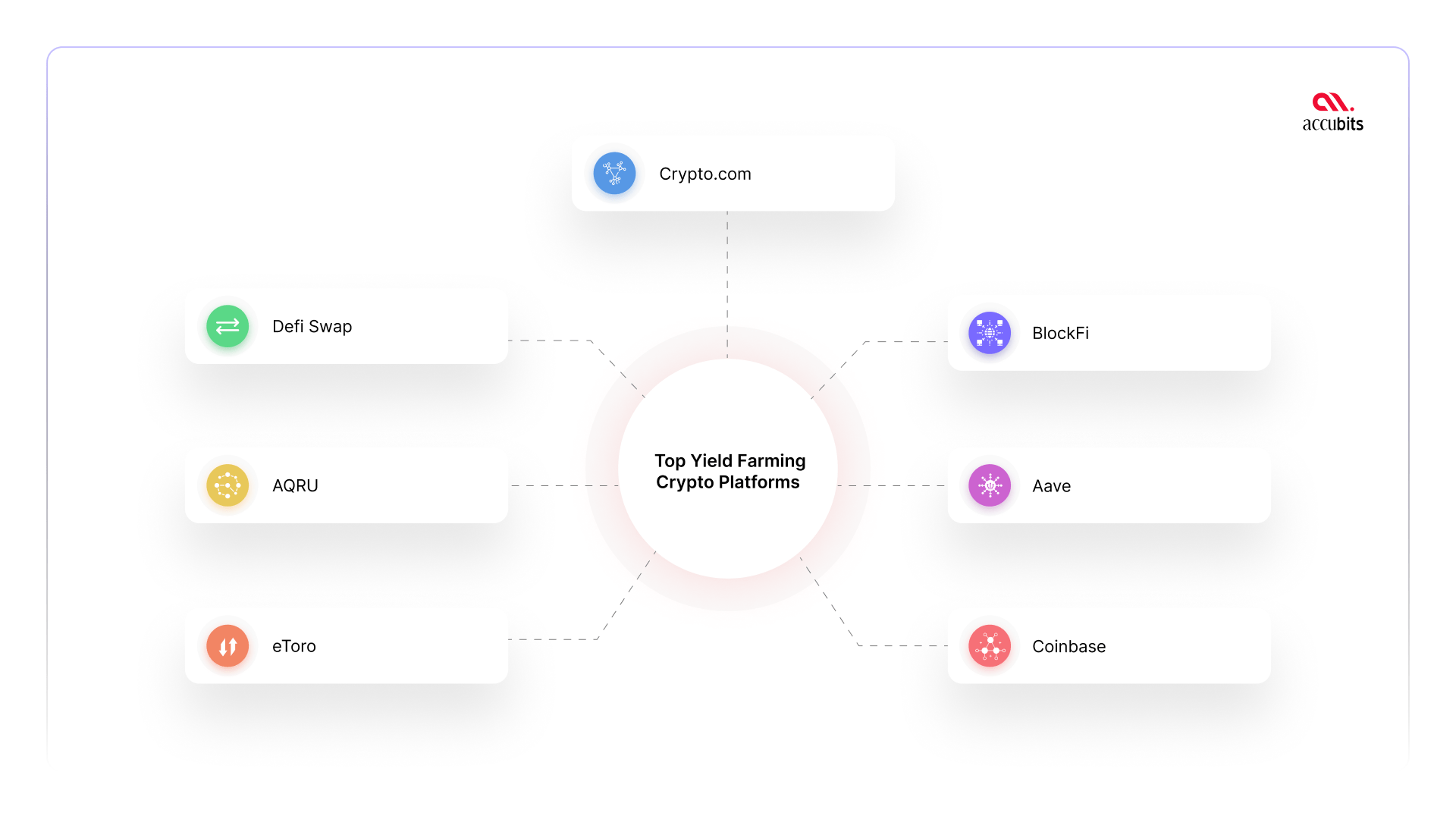

So let us see some of the top platforms in this domain.

Defi Swap is a cryptocurrency exchange platform that was launched in 2022. This platform has been gaining a lot of attention as it offers an impressively high APY return of about 75% if you would farm for a year and a 30% APY return if you would farm for 30 days. Staking is done primarily using the native token DeFi Coin (DEFC). Provided there is a commission for both farming and staking.

DeFi swap is a fully centralized exchange that facilitates easily swapping any stable cryptocurrency into a DeFi coin once you connect your wallet. DeFi swap is the exchange backed by a binance smart chain. The services of DeFi swap are available online for download or can be used through a decentralized app. One must connect the wallet to see the options and interest rates.

Pros

Cons

AQRU is a popular platform that allows stablecoins and cryptocurrencies without lock-in periods, i.e., withdrawal can be done anytime. The APY returns for coins like USDT, USBC, and DAI is about 12% annually; for BTC and eth, it is about 7 %APY. This platform charges $20 as a withdrawal fee. Aqru is better for the long-term holders of their available cryptocurrencies.

The safety of their crypto wallet is impressive as they are secured by fire blocks, one of the leading wallet infrastructure providers. A $30 million policy is in place to compensate for the consequences of theft if assets are stolen. On AQRU, there is a $100 minimum deposit requirement for crypto lending, and there is no minimum withdrawal requirement as long as customers can pay their withdrawal fees.

Pros

Cons

eToro is a new cryptocurrency exchange where you can exchange about 40 cryptocurrencies. But when it comes to yield farming, it is a relative innovation added to the features of the platform where only three coins, Cardano (ADA), Ethereum (ETH 2.0), and Tron (TRX), can be used. They are currently working on adding features to more coins. This platform offers a variety of Bitcoin goods. These include copying top traders, building portfolios, staking crypts, and using an earnings reports calendar.

This platform is regulated by SEC, ASIC, FCA, AND CySEC. Hence the features of Eli farming differ from conventional yield farm services, but eToro does allow you to earn passive interest.

The APY returns for Cardano are about 4.8% and about 5.5% for APY. The APY returns can vary based on the loyalty level in the eToro VIP program. One advantage feature is that there is no requirement to lock up our tokens for a minimum number of days as the interest-bearing tools are offered on a flexible basis. Etoro is many people’s favorite for its low-cost brokerage and exchange services.

Pros

Cons

Crypto.com allows users to stake crypto coins for a high APY interest of about 14%. There are several methods to earn yield, with the biggest yields available on Polkadot (DOT) and Polygon (14.5%) and on Bitcoin, Ethereum, Dogecoin, and more (MATIC). The number of native tokens deposited can also affect the APY returns. For instance, you must keep your tokens locked up for three months to obtain Tether’s full 14 percent APY. Furthermore, you must invest at least 40,000 CRO tokens for a 3-month fixed term. However, the APY drops to 6% if you deposit Tether without staking any CRO tokens and make flexible withdrawals.

Apart from interestingly high apy, crypto.com offers many options for earning. Even the holding plants are flexible. They can be held for a one-month fixed term and a three-month fixed term and about 50 varieties of coins can be used.

Pros

Cons

Coin base is one of the easy-to-use platforms with a simple, user-friendly interface. The newbies in the crypto world will greatly benefit from Coinbase as there is numerous educational information available. Achieving some of these resources entitles you to rewards and comprehensive courses on earning and generating farms from cryptocurrency.

Coin base allows users to choose the desired Defi protocol to earn interest. Interest may be earned on the following supported cryptocurrencies: ETH, ATOM, ALGO, DAI, USDC, and XTZ. The APY offered by ATOM is the highest at 5%. Despite being a fantastic option for newbies, Coinbase offers low APYs.

Pros

Cons

A user-friendly cryptocurrency platform with built-in exchange and wallet with many services and cryptocurrency investment opportunities. With BlockFi, stablecoins like USDT, DAI, and USDC may earn an APY of 8%. BlockFi offers traditional trading accounts in addition to basic crypto yield services, enabling you to purchase and sell digital assets and make some additional money in a side hustle. Most cryptocurrency owners are drawn to BlockFi Interest Accounts (BIAs) because of their monthly compounding crypto interest.

You may anticipate dividends that are market-leading if you choose to store your cryptocurrency with BlockFi. The platform does, however, employ a tiered interest structure. Therefore, your APY will vary according to the tier whether you decide to farm yields on your BTC, ETH, LTC, or LINK.

Pros

Cons

Users can borrow previously held Aave tokens using the noncustodial, decentralized Aave network, which runs on cryptocurrencies. Whenever a user lends their assets to the protocol, they receive a reward in the form of compound interest. The total worth of the protocol was approximately 14 billion dollars. Aave is currently worth more than 3.4 million dollars on the market. Aave includes additional benefits of fee savings and voting rights. The APY returns are in the range of 4.78 percent to 13.49 percent.

Once we stake the Aave coins, the platform will show us how much we have staked and how much we will earn each month. There is a cool-down period of 10 days when you decide to withdraw the tokens. Cool down period ensures the network is not disrupted if the number of tokens unstaked simultaneously is huge.

One benefit we could discuss without thinking much is the possibility of humungous return. The return is so huge that it is almost 100% more than the returns from traditional investment. This model potentially delivers better earnings than practically every conventional investment channel, including real estate, equities, shares, and bonds.

Available options for boosting profit by providing liquidity mining. Other than the high-interest rates, the lenders also get tokens from the company.

We may summarise the information about the platform as given below.

The returns from this model seem so high compared to the traditional returns and are super interesting but always remember that the process is not a cakewalk. Only proper research and a carefully curated strategy suitable for you would help you earn all such high returns. Also, don’t be misled by the false information prevailing in the industry based on enticing returns or scams. It is crucial to be cautious. If you plan to launch a platform based on this model, consult with a reliable DeFi development company to do a feasibility analysis for launching a metaverse solution for your business.