We live in an era of cryptocurrency that showers new coins to the market now and then. Investors and crypto enthusiasts are looking for ways to store and exchange digital assets to gain maximum returns. There is a huge market for blockchain exchanges to provide a better and more seamless experience to tens of millions of crypto users.

You must be familiar with the top guns in crypto exchanges like binance, Gemini, and Coinbase, which have a good share of the crypto market. But they pose many issues and limitations that disrupt seamless transactions of cryptocurrencies. So yes, the need for a kickass blockchain-based crypto exchange is in demand!

Take a look at the key points to create a well-optimized Crypto exchange and how to empower the crypto business with Crypto exchanges.

Blockchain exchange is a crypto platform to sell and buy cryptocurrencies. You can use this platform to trade one crypto for another. You can exchange Bitcoin for Ethereum. In addition to trading services, Crypto exchanges offer storage for crypto and price discovery.

Before the advent of cryptocurrency exchanges, consumers could only purchase cryptocurrency by mining or setting up transactions from different online and offline forums. Now many exchanges provide a wide range of digital assets, security levels, and fees.

According to Tyrone Ross, a financial adviser and CEO of Onramp Invest, a crypto-investing platform for financial advisors,

“No one blockchain exchange is appropriate for every customer or business.”

Instead, he advocates evaluating your specific crypto interests and establishing an exchange that aligns with your business requirement.

Related article: How to launch a cryptocurrency exchange.

According to one estimate, from late 2020, more than 18,000 companies started accepting crypto payments; many businesses worldwide are utilizing cryptocurrencies and other digital assets for myriad investing, operational, and transactional objectives.

Related article: How to approach blockchain app development in 2022?

The usage of cryptocurrency for business brings both opportunities and challenges. As with every frontier, there are unknown perils and powerful incentives. As a result, businesses looking to integrate cryptocurrency into their operations should look for exchanges adapted to their needs.

In short, developing one for your business helps you:

Related article: Crypto Exchange Development Checklist

According to renowned investor Peter Lynch, “During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents, and blue jeans earned a good profit.”

In the gold rush that is the cryptocurrency boom, one can connect the manufacturer of picks and shovels to the owners and operators of exchanges. If you see the potential benefit and want to create your own cryptocurrency exchange business, this step-by-step approach will help you get started.

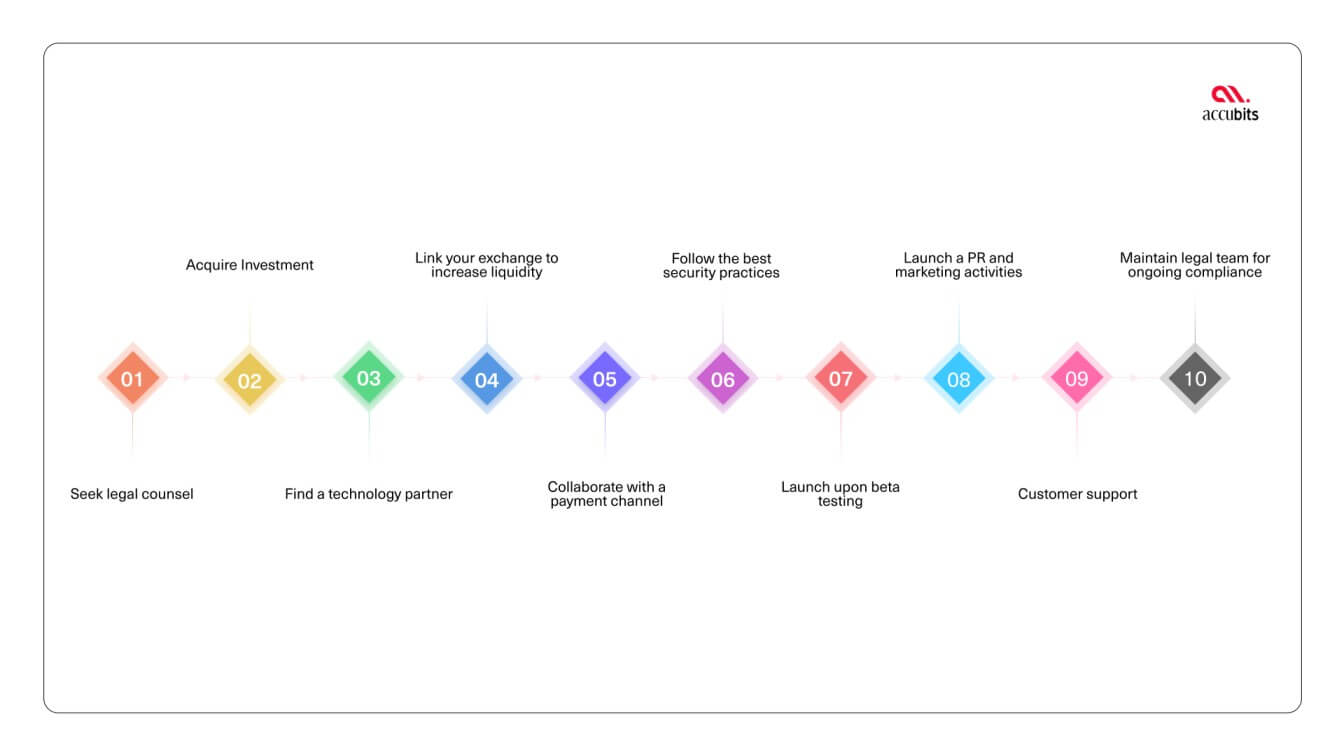

The primary steps to getting started with a cryptocurrency exchange are:

Before you implement a project, it is advised to seek legal counsel to understand the regulatory requirements for your new business. Make sure that proper licensing is made and legal formalities are straight in the books of all the jurisdictions in which the company intends to operate.

Many cryptocurrency exchange owners operate without much of a vision as the government and regulations are yet to keep up with the pace of the technology. On the other hand, exchange owners in the United States and other places can only operate under a Licensed Money transmitter business and strictly follow the SEC and CFTC rules.

Since exchanges operate under the currency exchange division, the business should follow the Know Your Customer (KYC) requirement to prevent money laundering. They are keeping all of these things under consideration. It is advisable to hold legal representation.

They evaluate the estimate of the project before you start the project. This comprises technology hosting, first legal guidance, government registration, and initial advertising. While not all funds are necessary upfront, the business must access sufficient financing to provide a proper runway.

One crucial mistake most startups make is neglecting to plan for the future. This can leads to meager first fundraising that can cover only the development costs but deprives the business of the crucial operating money needed until it is profitable.

Startups commonly make the mistake of getting approval from unethical cryptocurrency exchange providers that expect recurring payments but fail to reveal the legal obligations and costs involved in setting up and running an exchange.

Having a blockchain development company as your technology partner is necessary. They can help you develop your exchange without technical difficulties, and their expertise can help you have a well-secured and optimized platform. In some instances, building the exchange from scratch is time-consuming, expensive, and tedious. To have a quick solution in hand, configure your business needs to Whitelabel Crypto Exchange and launch your exchange in a very short period.

You can use Accubits Whitelabel Crypto Exchange, configuring it to your business requirement. This platform is 100% customizable, and it is integrated with all advanced functionalities that are needed for your business. Accubits have 15+ years of experience in blockchain technology and software development.

Liquidy plays a vital role in every profitable exchange. Potential clients will have difficulty trusting your enterprise if it does not have a proper order book and trading activity. We can help you to improve your liquidity by integrating your exchange with a network of active exchanges. On the other hand, you do not have to run around with fake activities inside the new exchanges.

To compete with other exchanges, you must have low transaction fees. The exchanges should collaborate with payment processors to get a good deal on the fee structure. Additionally, read the agreement carefully before signing up, like some payment processors, including hidden charges, settlement time, and adherence to PCI DSS. Keep in mind that many state laws in the US do compel compliance, and federal law doesn’t protect your new business from online fraudulence.

We build exchanges using offline cold storage wallets, two-factor authentication, and encrypted databases to ensure military-grade security, The final thought? Since cryptocurrencies are now a prime target for hacking and fraud, exchanges try to distinguish themselves apart on the merit of security.

Your exchange is now built. You’ve established an agreement with a company that processes payments. You’ve also taken great care to ensure your trade complies with all laws and guidelines. You have made sure that cybercrime won’t affect your business. Launch your exchange and run all of its features through a beta test.

Connecting with crypto news publications is a good idea once your exchange has launched. It’s crucial to plan your marketing efforts and their associated expenditures carefully. Until they achieve a certain number of traders, exchanges frequently do not have a marketing budget and prioritize free social media promotion.

Although providing excellent customer service is the final stage in creating a successful cryptocurrency exchange, how well you do in this area will define your success over the long run. Consumer-facing personnel must pay close attention and address customer grievances and technical concerns successfully. Since cryptocurrencies never stop trading, you should establish a ticketing system and staff it with trained and friendly people who are ready 24/7 to answer customers.

Related article: Bridging the cryptocurrency gap between retailers and consumers

We cannot overstate the importance of maintaining legal compliance. Ensure to follow the current and forthcoming rules and regulations. It applies to your geographic location and other countries where your exchange traders reside. It is essential to hire a full-time in-house legal compliance team or outsource to reputable law firms to keep your exchange legitimate in all countries where you will conduct business. This is due to the rapid global movement in cryptocurrency regulations.

Understanding and observing other exchanges is crucial to bring out the best crypto exchange into the market. It is crucial to look at different factors of other established exchanges, such as supported assets, fees, payment methods, and security. Here are the top crypto exchanges to look out for.

So, let’s start today. If you want to see your exchange in the list of top crypto exchanges. Contact us here

Businesses are eager to start their blockchain exchanges as more crypto enthusiasts enter the industry. However, designing it from scratch might be difficult regarding cost, deployment time, and the work required. This is when starting a crypto-based exchange with white-label solutions comes in handy.

Finally, it allows you to reasonably design and operate quick, secure, and configurable crypto-based exchanges. In this manner, you can take advantage of crypto growth opportunities, which may propel your crypto trading company to new heights.