Are you planning to launch a neobanking app or product? Our whitelabel neobank apps and platforms can help you launch your Neobank product in the shortest time with minimal capital investments. Need a demo? Hit the contact form, and we'll email you the demo videos and more.

We enable you to Go-to-market faster with minimal capital investments.

Our whitelabel neobank solutions are completely customizable to meet your business's branding and functionality requirements.

We offer fintech consultation services to help you easily get your banking licenses, compliances, etc., for launching your neobank.

Our white label neo banking platforms offer a wide range of third-party integrations to help you launch a sophisticated application.

Financial products and services built on emerging technologies are dominating the BFSI markets. Launch your neobanking app with our whitelabel apps, platforms, and solutions. We offer;

To win the market and build a strong customer base, you need more than just a normal fintech app. You need a habit-forming app built using behavioral analytics and user psychology. We know the science behind it. Our research-driven Hook & Nudge App development model ensures your app's best possible outcome.

We offer managed services to support your neobank's successful operations. Reach out to us today to schedule a no-obligation consultation to help you get started.

Reach out to us today to avail online demo access and more!

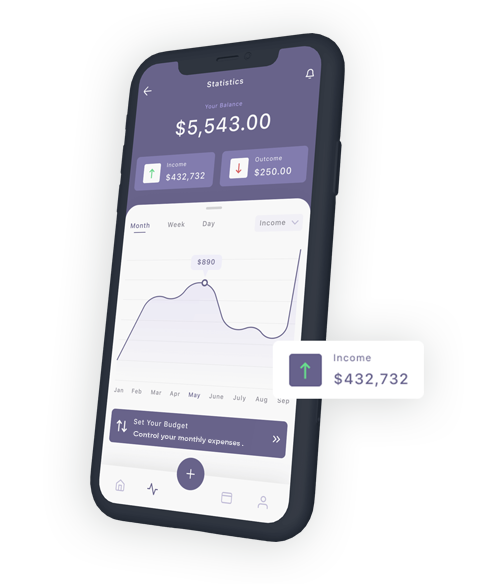

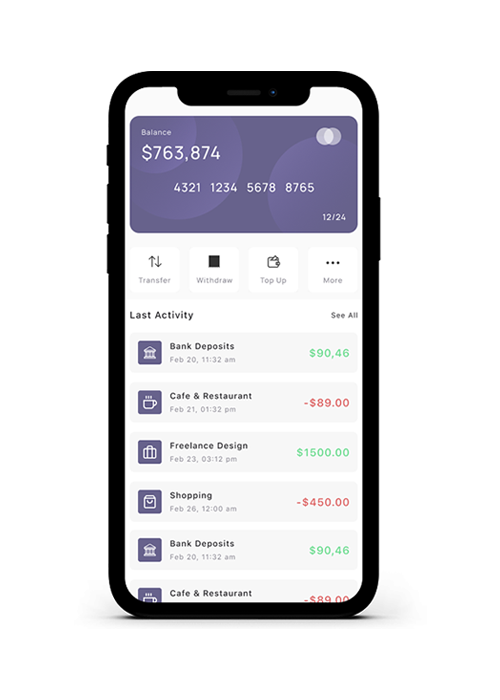

Our whitelabel neobank platforms and apps let you issue branded cards, introduce savings and loans, allow domestic and cross-border money transfers, digitally onboard users, and more. On top of that, it offers back-office features to enable secure and compliant operations.

Core banking software, Card & Payment solutions, Risk & Compliance, Wealth Management, KYC & AML Management, user management, etc.

Omni channel banking, data analytics, customer onboarding, experience management, gamified user interactions, and more.

We have global partners to help you issue branded virtual and physical payment cards that offer attractive financial services.

Our whitelabel neobank apps support and provide features powered by AI, blockchain, and web3-based technologies.

Offer multiple services, including payment and financial transaction processing. Be an all-encompassing self-contained super app.

Need to add custom workflows and features for your product? We got you covered with our end-to-end customization feature.

Change the way people do finance with out-of-the-box Neobank apps. We help you convert your ideas into fully-fledged products. Let's talk?

“Accubits' platform has garnered thousands of users and become a trusted tool for business transactions. Flexible, and responsive, they managed the project well and had no issues with language barriers or deadlines.”

CEO, International Deal Gateway

"Accubits brought their full experience in this project and was able to improve the ideas we came up with by far. These changes were substantial and did allow us to work with more then one group at the same time."

Founder, ATROMG8

"In handling unexpected marketplace requirements, Accubits team has proactively offered suggestions and ideas. Their ability to deliver custom solutions within budgetary and timeline restrictions is notable."

Founder, eBlaze Marketing Inc

Reach out to us today to get started.

Delivering the banking experience the way you’ve always wanted - effortless, automated & better.

You are just one step away from making the right decision. Let's get started, shall we?

Customer care :

+1 703

337 3121

Office Address :

8230

Boone Blvd, Vienna,

Virginia 22182, United States

Email Address :

contact@accubits.com